- AI Business Summary

- Posts

- 💻 The Chip Wars Heat Up: Microsoft vs Nvidia, Apple's Siri Shift & $4B Valuations

💻 The Chip Wars Heat Up: Microsoft vs Nvidia, Apple's Siri Shift & $4B Valuations

This week's report backed by stats!

When Is the Right Time to Retire?

Determining when to retire is one of life’s biggest decisions, and the right time depends on your personal vision for the future. Have you considered what your retirement will look like, how long your money needs to last and what your expenses will be? Answering these questions is the first step toward building a successful retirement plan.

Our guide, When to Retire: A Quick and Easy Planning Guide, walks you through these critical steps. Learn ways to define your goals and align your investment strategy to meet them. If you have $1,000,000 or more saved, download your free guide to start planning for the retirement you’ve worked for.

Welcome back to the AI Business Summary newsletter!

This week, we have more significant (and mostly positive) news in the world of AI.

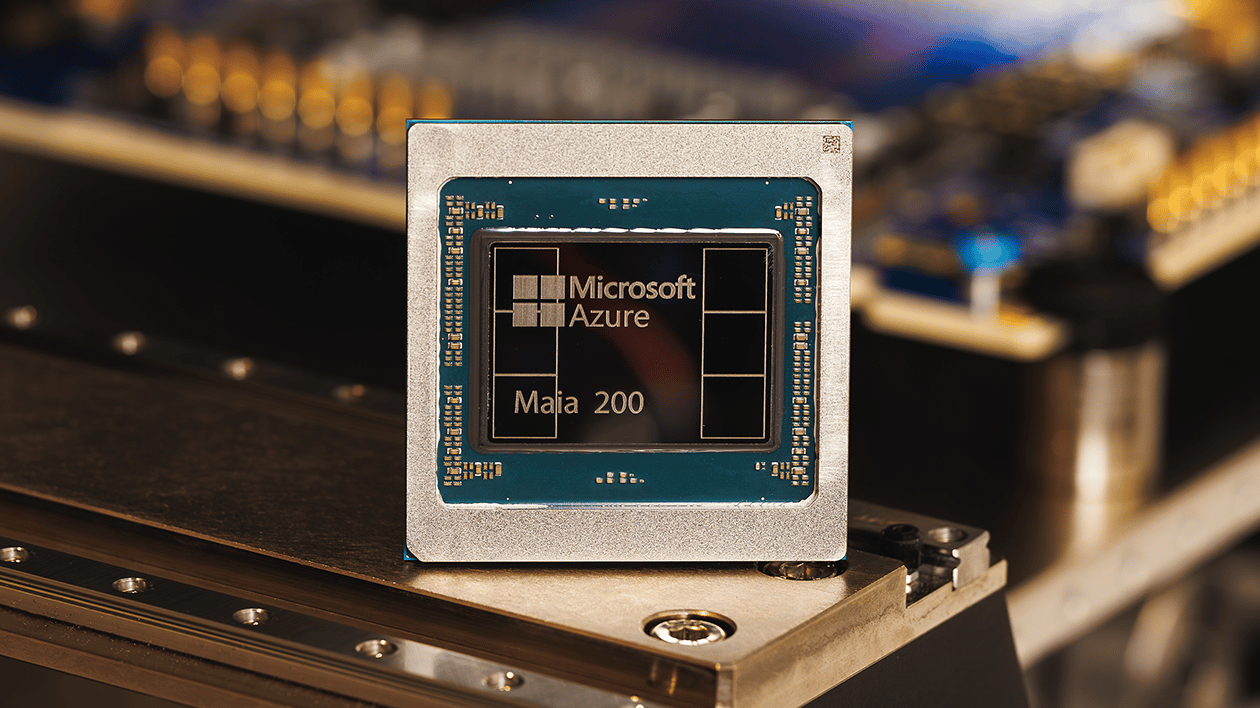

The Big Lead: Microsoft launches its second-generation Maia 200 AI chip with Triton software tools this week, directly challenging Nvidia's CUDA dominance as cloud giants race to reduce dependence on external chip suppliers

Here’s everything else you need to know this week in AI...

In Today’s Issue:

💻 Microsoft launches Maia 200 AI chip to challenge Nvidia

💰 Nvidia invests $2 billion in CoreWeave to build AI factories

🌦️ Nvidia launches Earth-2 platform for weather forecasting

🛠️ Anthropic launches interactive Claude apps for enterprise

🎬 Synthesia hits $4 billion valuation with $200 million funding round

🏦 Wells Fargo hires AWS executive to expand AI use

🍎 Apple to unveil Gemini-powered Siri in February

📧 Google fixes Gmail spam filter breakdown

🏛️ SEC drops lawsuit against Gemini crypto exchange

🚌 NTSB investigates Waymo for passing stopped school buses

Business Models & Monetization

💻 Microsoft launches Maia 200 AI chip + software to challenge Nvidia

Second-gen in-house chip goes live this week in Iowa data center.

Includes Triton software tools, taking on Nvidia's CUDA advantage.

Uses 3-nanometer tech + SRAM memory for speed boosts.

Targets chatbot performance with high concurrent user loads.

💰 Nvidia invests $2 billion in CoreWeave to build "AI factories"

Deal adds 5+ gigawatts of AI computing capacity by 2030.

CoreWeave will integrate Nvidia's new Rubin chips, Bluefield storage, and Vera CPUs.

CoreWeave has $18.81 billion in debt but hit $1.36 billion in Q3 revenue.

Stock jumped 15% on news; customers include OpenAI, Meta, and Microsoft.

🌦️ Nvidia launches Earth-2 AI platform for weather forecasting

New AI models aim to improve prediction accuracy and speed.

Targets climate research, disaster preparedness, and energy planning.

Leverages Nvidia's GPU infrastructure for faster simulations.

Positions AI as a critical tool for climate resilience.

Enterprise Tools & Applications

🛠️ Anthropic launches interactive Claude apps for enterprise users

New apps integrate Slack, Canva, Figma, Box, and Clay directly into Claude.

Users can send messages, generate charts, and access cloud files without switching tabs.

Available to Pro, Max, Team, and Enterprise subscribers, not free tier.

Built on the open Model Context Protocol; coming soon to the Claude Cowork agent.

🎬 Synthesia hits $4 billion valuation with $200 million Series E

AI video platform doubled its valuation in one year.

Crossed $100 million annual recurring revenue in April 2025.

Enterprise clients include Bosch, Merck, and SAP for training videos.

Facilitating employee secondary sale via Nasdaq at the same $4 billion valuation.

🏦 Wells Fargo hires AWS executive to expand AI use

Bank taps Amazon Web Services leader to accelerate enterprise AI adoption.

Move signals Wells Fargo's push to modernize operations with AI tools.

Part of the broader financial services AI race.

Details on role and strategy are still emerging.

Consumer Tech & Platforms

🍎 Apple to unveil Gemini-powered Siri in February

First major Siri upgrade using Google's AI models, per Bloomberg.

Will access personal data and on-screen content to complete tasks.

Bigger conversational upgrade planned for June at WWDC.

May run on Google's cloud infrastructure.

📧 Google fixes Gmail spam filter breakdown

Saturday's outage caused misclassification of emails and inbox flooding with spam.

Promotions, Social, and Updates messages are dumped into the Primary inbox.

The issue lasted several hours; Google says it is fully resolved for all users.

Internal investigation underway; analysis coming soon.

Regulation and Safety Concerns

🏛️ SEC drops lawsuit against Gemini crypto exchange

Winklevoss twins' company off the hook after NY settlement.

Investors recovered 100% of their crypto assets from the collapsed Earn program.

Part of the broader President Trump-era leniency, 60% of pending crypto lawsuits were dismissed or paused.

Gemini has filed to go public.

🚌 NTSB investigates Waymo for passing stopped school buses

Over 20 incidents in Austin, Texas; similar reports in other states.

First NTSB investigation into Waymo; NHTSA also probing.

Previous software recalls failed to fix the problem fully.

Waymo claims no collisions and safety superior to human drivers.

🌱 Bonus Thought

OpenAI's CFO calls it the year of "practical adoption." Microsoft bets big on in-house chips. NVIDIA pours $2 billion into AI factories. Everyone is scaling. The money is flowing. But the real question remains: who actually captures value?

OpenAI's revenue surged from $2 billion to over $20 billion as compute expanded tenfold. That's impressive. It's also a reminder that revenue isn't profit, and growth at scale doesn't mean sustainable business. Critics point out that selling dollars for $0.70 only works until it doesn't. Spending vs. sustainability. Speed vs. profitability. Adoption vs. integration.

The pattern across this week's headlines is clear: infrastructure is no longer the bottleneck. Enterprise tools exist. Chips are shipping. The gap now sits between what AI can do and what businesses actually use it to accomplish. Waymo's school bus incidents and Gmail's spam meltdown show the risk side. Synthesia's $4 billion valuation and Claude's enterprise apps show the opportunity. Both happen simultaneously.

The winners won't be whoever scales fastest. They'll be whoever closes the adoption gap while building systems people actually trust.

📝 Business Prompt to Try

"Act as a technology risk strategist. Audit our current vendor dependencies across cloud infrastructure, AI models, enterprise software, and critical business tools. For each vendor relationship, assess: (1) percentage of operations dependent on this single provider, (2) cost to migrate to alternatives, (3) contractual lock-in terms and exit penalties, (4) availability of comparable alternatives. Then identify our top 3 concentration risks and recommend one actionable diversification move for each that we can execute in 90 days. Include estimated implementation costs, downtime risks, and quantified benefits of reduced vendor lock-in. Present as a risk-weighted matrix showing current exposure vs. post-diversification resilience."

Why It Works

Addresses the infrastructure power shift happening now: Microsoft launching Maia chips to challenge Nvidia, Apple abandoning its AI stack for Google's Gemini—Big Tech is redrawing vendor relationships. Companies stuck with single providers face pricing pressure and forced migrations.

Quantifies hidden concentration risk: Most businesses don't realize 60-80% of operations run through 2-3 vendors until pricing changes or service disruptions hit. This prompt surfaces dependency before it becomes a crisis.

Mirrors the enterprise chess game unfolding: Just as Anthropic built Claude apps on open protocols and CoreWeave diversified beyond pure Nvidia dependence, smart operators build optionality before they need it.

Balances stability with strategic flexibility: Acknowledges that not all vendor relationships need disruption—focuses on the 3 highest-risk dependencies where alternatives exist, matching how enterprises actually prioritize infrastructure decisions across cost, capability, and control trade-offs.

💡 Quote of the Week

AI is the definisng technology of our times